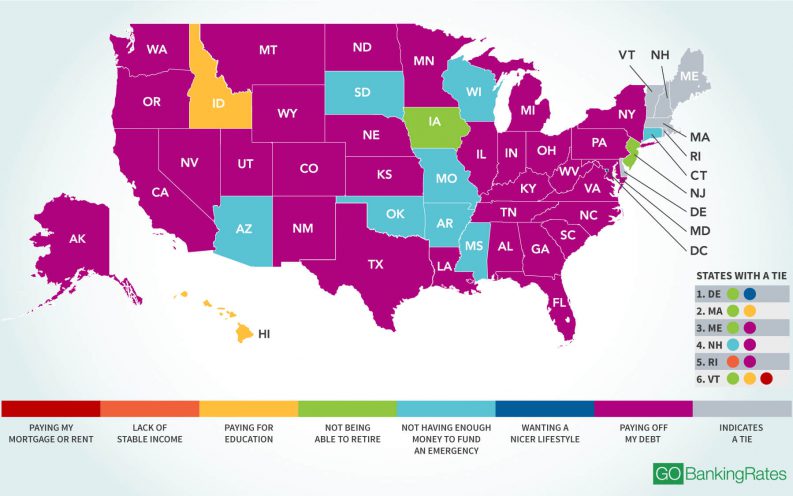

What’s the #1 cause of financial stress in your state?

Americans are becoming increasingly stressed over their finances. In fact, the current financial stress rates in the U.S. are among the highest they have ever been over the last five years, according to consulting firm PwC’s 2016 Employee Financial Wellness Survey.

To find out exactly what is causing so much financial stress among many Americans, GOBankingRates.com surveyed more than 7,000 people in all 50 states and the District of Columbia and asked them: “Of the following, what is your No. 1 cause of financial stress?”

The survey respondents had seven options to choose from:

• Paying off my debt (i.e. credit cards)

• Not being able to retire

• Not having enough money to fund an emergency

• Wanting a nicer lifestyle

• Paying for education

• Lack of stable income

• Paying my mortgage or rent

Among all states and DC, the most common answer respondents gave was “paying off my debt,” followed by “not being able to retire” and “not having enough money to fund an emergency.” The least popular answer was “paying my mortgage or rent.”

Regardless of the cause of financial stress, it’s important to address it rather than ignore it, said Stephen Alred Jr., founder of fee-only financial planning firm Ignite Financial.

“Create a strategy, or hire a professional to create one for you that will have actionable steps,” he said.

Illinois: Paying Off My Debt

The total debt balance per capita in Illinois is about on par with the national average — yet, it’s still a hefty $45,010, according to the Federal Reserve Bank of New York. However, Illinois has a higher student loan debt balance per capita and slightly higher credit card debt than the national average.

Credit: GoBankingRates.com / CFP.net

Note: The opinions voiced in this material are for general information only and not intended to provide specific advice or recommendation for any individual. Please remember that past performance of investments may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this post serves as the receipt of, or as a substitute for, personalized investment advice from Vermillion Financial Advisors, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed within this newsletter to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.

For more information, or if you have any questions at all feel free to call us or set up an appointment!