UPDATE: (6/28/16 3:00PM CST)

Early Friday, Reuters reported on the immediate and potential repercussions of the decision:

“Britain has voted to leave the European Union, forcing the resignation of Prime Minister David Cameron and dealing the biggest blow since World War II to the European project of forging greater unity. Global financial markets plunged on Friday… The British pound fell as much as 10 percent against the dollar to levels last seen in 1985… The euro slid 3 percent… World stocks saw more than $2 trillion wiped off their value, with indices across Europe heading for their sharpest one-day drops ever… The United Kingdom itself could now break apart, with the leader of Scotland – where nearly two-thirds of voters wanted to stay in the EU – saying that a new referendum on independence from the rest of Britain was ‘highly likely.’ ”

U.S. stock markets dropped sharply, too. Barron’s reported that the markets’ response to the British exit (Brexit) didn’t indicate the bull market in America was over. Citing a report from Morgan Stanley, the publication noted that American companies generate 70 percent of revenues domestically, which means U.S. stocks are less susceptible to the vagaries of international events than those of many other countries. That may make U.S. stock markets attractive to investors.

During the next few weeks, as the immediate and extreme response to the news settles and investors realize little will change immediately, the world should gain a better understanding of the ways in which Brexit will affect Britain and everyone else.

It seems likely that the British government will spend the next few weeks or months developing a strategy for its departure from the EU.

Right off the bat, the British need to put a new leader in place. Prime Minister David Cameron resigned after his side lost Thursday’s vote. Cameron’s comments suggest that he does not plan to invoke Article 50. He indicated that the new Prime Minister should be responsible for initiating the process.

Article 50 is a clause in the Lisbon Treaty describing the legal process a country must follow to notify the European Union that it intends to withdraw. Once notification is delivered, there is a two-year window to complete negotiations. Any extension of negotiations requires the agreement of all EU members.

Once they’ve given notice, the U.K. will have to negotiate the terms of its exit from the EU and establish the terms of its future relationship with the group. According to the International Monetary Fund (IMF), the nation will also need to renegotiate trade relationships with 60 or so non-EU countries where its trade is currently guided by EU agreements.

No one can be certain how Britain’s economy will be affected as the nation determines its new position in the world’s pecking order. However, The Economist reported on two possible futures, as set forth by the IMF:

“In the first scenario, Britain quickly agrees on a new trade deal with the EU; in the second, the negotiations are more protracted and Britain eventually settles for basic World Trade Organization rules. In the first scenario, sterling depreciates by 5 percent. GDP growth slips to 1.4 percent in 2017 and unemployment rises slightly… In the second scenario, Britain falls into recession next year. Unemployment hits about 7 percent by 2018, up from around 5 percent now (during the financial crisis it peaked at 8.5 percent). Real wages will stagnate, mainly because of high inflation. Surprisingly, Britain’s trade balance will move into a small surplus, thanks not to the dynamism of exporters but ‘because demand for imported goods plunges due to exchange-rate depreciation and reduced consumption.’ ”

In a victory speech, Boris Johnson, former Mayor of London, Brexit supporter, and a favorite to become the next Prime Minister, said:

“In voting to leave the EU, it is vital to stress that there is no need for haste… There is no need to invoke Article 50… We have a glorious opportunity to pass our laws and set our taxes entirely according to the needs of the U.K.; we can control our borders in a way that is not discriminatory but fair and balanced and take the wind out of the sails of the extremists and those who would play politics with immigration.”

EU leaders appear to have a different timetable in mind than recommended by Cameron and Johnson. In a joint statement, Martin Schulz, President of the European Parliament, Donald Tusk, President of the European Council, Mark Rutte, Holder of the Presidency of the Council of the EU, Jean-Claude Juncker, President of the European Commission, said:

“We now expect the United Kingdom government to give effect to this decision of the British people as soon as possible, however painful that process may be… We hope to have [the U.K.] as a close partner of the European Union in the future. We expect the United Kingdom to formulate its proposals in this respect. Any agreement, which will be concluded with the United Kingdom as a third country, will have to reflect the interests of both sides and be balanced in terms of rights and obligations.”

Will this be the glorious opportunity promised by the leaders of the ‘leave’ side or a tragic split as predicted by the ‘remain’ leaders? Much depends on when and what Great Britain negotiates with the EU. In the meantime, there is likely to be considerable economic uncertainty and some market volatility.

British voters seem to have given serious thought to the implications of their choices after the polls had closed. Don’t be surprised if there is a great push for a second vote in the coming weeks.

Original Post: (6/27/16 10:00AM CST)

(The Economist)

As it became clear overnight that the UK had voted to leave the European Union, the pound plunged by over 10% against the dollar to a 30-year low, and markets around the world plunged (in parts of Asia, by nearly 10%, and so far more than 3% in the U.S. as well) as U.S. Treasuries rallied.

Of course, the reality is that Great Britain accounts for less than 4% of the world’s economic output, which means that even with an adverse recession there it doesn’t really have a significant economic impact on the global economy.

The Bank of England has stated that it was ‘prepared’ for this, and will cut interest rates if necessary (to the extent possible given its 0.5% level, or possibly even revive its own quantitative-easing program). In addition, the majority who voted to leave the EU have characterized a potential UK recession as a “scare tactic” of the Remain advocates, and thus may not curb their spending very quickly anyway.

Nonetheless, as the outcome of the Brexit vote unfolds, investment begins to scale back, and the falling pound makes foreign goods more expensive (essentially “importing inflation” to British citizens). Spending may slump there, and a recession still seems likely, which in turn could spill over into a recession for much of Europe. However, the real driver of the market volatility so far has arguably not been the immediate economic impact, but the uncertainty that it has introduced.

The referendum and outcome in the UK may lead to a referendum in other European countries that have been unhappy with their plight in the European Union, which means a new form of ‘European Union breakup contagion’ fear may be taking hold. In addition, Britain will now have to (re-)negotiate a regional trade deal with the European Union, which may be challenging as EU leaders try to extract trading concessions from Britain in exchange for the chaos and political uncertainty they have unleashed (not to mention the overall rise in protectionism that has been sweeping through the G20 countries in recent years).

And of course, the longer that all of this takes to unfold – which could be years – the more uncertainty there is remaining, which is often more of an impediment to markets than the events and their economic outcomes themselves.

(Zack Beauchamp, Vox)

The big discussion today has been the economic ramifications of the UK’s decision to leave the European Union, but a detailed look at the voting numbers and rhetoric leading up to the decision wasn’t about economic policy but immigration policy.

At issue is the massive surge of immigration that the UK has experienced since joining the European Union. While prior to 1993, net migration to the UK was less than 100,000 people per year. The foreign-born population of the UK more-than-doubled over the subsequent 20 years; going from 3.8 million to 8.3 million. This shift accelerated over the past 10 years as the EU expanded to include a number of mostly-post-Communist countries in central and eastern Europe, who began migrating to the UK for job opportunities. The percentage of migrants entering the UK from Europe then spiked going from 25% to 50% in barely a decade (which was further accelerated after the financial crisis as hard-hit countries like Spain, Italy, and Portugal also saw increasing migration to the UK with the rise of unemployment in their own countries).

Given this dynamic, being a part of the EU became linked with immigration in the minds of many Brits, and the referendum on the EU turned into a referendum on immigration, with the primary focal point of the “UK Independence Party” (UKIP) becoming ‘a vote to leave the EU is a vote to regain control of UK immigration policy’ (as membership in the EU requires rather open cross-EU borders). In the end, the UK vote was not really framed as whether it’s better economically to be part of the EU or not, but instead turned into a decision of whether it would be worth regaining control of immigration despite the economic consequences… to which the “Leave [the EU]” vote had a surprise win by a small margin.

(J. Reed Murphy, Chief Investment, Officer Trust Company of Illinois)

In a twisted play on the famous Paul Revere warning that “The British Are Coming!”, the British people have voted to leave the European Union (EU). This announcement is reaching far beyond the Massachusetts towns that Paul Revere once road on his horse in the dark of the night. It has shocked markets as recent polls, surveys and investors were expecting a “remain” vote. In fact, the FTSE index of the largest 100 companies trading on the London stock market exchange was up approximately 5.5% from last Friday’s close through Thursday’s close in anticipation that Brits would vote to remain in the EU.

As we write this, the FTSE is down approximately 2.4% after being down nearly 9% earlier in the day. Other European equity markets are worse. The S&P 500 is down approximately 2%, cutting in half the decline that futures markets were predicting.

What this means is hard to comprehend as no country has ever left the EU, but the estimates are extreme.

The Organization for Economic Cooperation and Development (OECD) forecasts that the British economy (i.e., GDP) could decline 3.3% by 2020 and a further 2.7% to 7.5% by 2030. Forecasts also suggest that total trade could decline 10-20% (OECD) and that jobs could decline by 350,000 to 600,000 by 2030 (CBI).

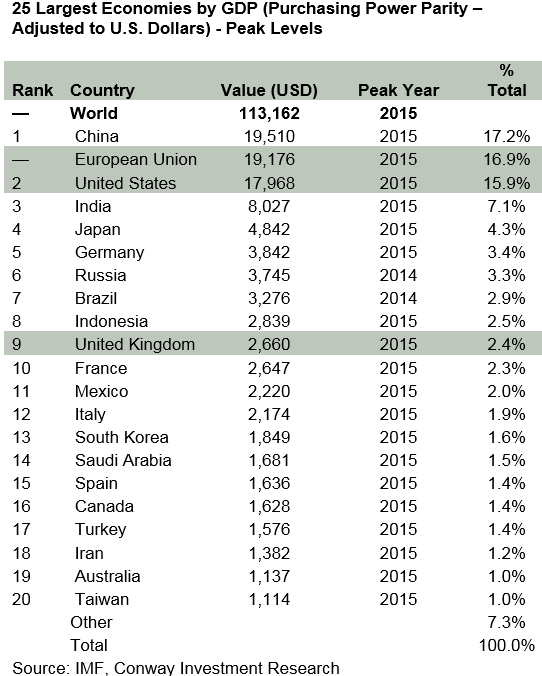

The U.K. government warned that leaving the EU would kill jobs, create currency turbulence and pull the economy into a recession. However, it is important to keep the size of the U.K. in context within the global economy. The U.K. accounts for 2.4% of global GDP. Nonetheless, the contagion effect on the viability of the EU, currencies and global trade is what is weighing the most on investors’ minds today.

The EU is a political and economic union of 28 member states primarily in Europe.

Benefits include a single market with common laws that control the free movement of people, goods and services. Additionally, 19 members have adopted a common monetary union and currency known as the Euro.

The challenge of this union to have its member countries create a common monetary policy, while each still has its own fiscal policies (within some EU guidelines) and individual sovereign rights. It’s a very tall order, and therein lies the root of the British decision to exit the EU.

There is a populist and nationalistic movement afoot globally and the UK was not immune. British elections in 2016 incented the British Prime Minister, David Cameron, to promise an EU referendum on EU membership which took place this week ending in today’s result. During the winter, the Prime Minister traveled Europe to renegotiate even more favorable arrangements. Nonetheless, voter concerns over a few issues outweighed the benefits of EU membership and the dire warnings of many politicians and economists. What are some of those issues?

1. Trade – EU membership entails no trade tariffs on imports and exports between member states. While the UK may lose some negotiating power by leaving, they will need to renegotiate trade deals. Other countries have negotiated favorable trade agreements with the EU, however many believe that the EU will make it hard on the British so as to set an example for any other country that may consider leaving the EU.

2. Sovereignty – Voters for an exit (i.e., Exiters) argue that the UK has given up some internal democratic powers in place of EU mandates, despite the UK having a voice at the table.

3. Immigration & Jobs – Under EU law, members cannot prevent anyone from another “member state” from coming to live in their country. Exiters argue that others coming into the country take jobs away. These embers of worry grow into flames when terrorism is on the rise, despite the indirect connection. There are shared intelligence and security benefits of membership also. Those who voted to remain (i.e., Inners) argue that the British also enjoy the right to travel and live in other EU countries and that the economic benefits to Britain in all circumstances has been favorable. Ironically for Exiters, estimates by the OECD are that net immigration will fall by 56,000 to 116,000 relative to a potential job loss of 350,000 to 600,000 (CBI).

There are many events that have already unfolded with many more to come. Being that no country has ever exited the EU before, we are in uncharted waters.

• UK Prime Minister – Dave Cameron, the British Prime Minister, has already announced that he will step down in the near future. There will be a new election, most likely in the upcoming months.

• New Referendum – There is a low probability chance that external pressures will mount so much that another referendum vote will be called.

• Actual Leaving – The UK will implement Article 50 of the Lisbon Treaty (EU governing treaty), which requires the exiting country to notify the European Council of its intentions and framework for future relationships with the EU. That agreement must be approved by the European Council. Being this is the forum for negotiations on terms that will dictate the financial impact of the Brexit (British Exit) and that it is expected to take up to 2 years, this drama will continue to play out.

• Other Elections – There are several other countries that have similar referendums in the upcoming years. Hence, the posturing and negotiations of the EU with the UK has far reaching impacts for the EU itself.

• Central Banks – Central banks have already communicated plans to step in to provide liquidity and stimulus where needed.

First – We need to keep in mind that high drama is a consistent theme in politics and investment markets. The populist movement that was a catalyst for the Brexit vote is also unfolding here in the U.S. So, we are not immune from these issues even in our own country.

Second – We need to realize that the U.K. accounts for 2.4% of global GDP (USD adjusted) and 4.4% of global exports. While Brexit could impact other countries, no one expects that global trade will dry up because the UK has to renegotiate trade agreements. Even if other countries end up leaving the EU, global trade will continue, just under new norms.

Third – The world is interconnected, so it is still wise to invest internationally. In fact, the U.S. only represents 16% of global GDP and approximately 50% of global equity market capitalization. Those U.S. companies generate significant revenues in foreign countries. Some of the best investment opportunities still reside outside the U.S.

Fourth – The markets always climb a wall of worry. This is another step on that journey.

Fifth – several asset classes are actually doing well today. While many assets like equities are down, many others like U.S. bonds are doing well. Other asset classes we have invested in can benefit from these trends as well.

In summary, as with all other economic crises and financial market movements of the past, sticking to your long-term asset allocation mixture, not panicking, and staying invested is generally the best advice available.

your Vermillion Financial Advisor with any questions.

With sincere appreciation, Mark La Spisa

Note: The opinions voiced in this material are for general information only and not intended to provide specific advice or recommendation for any individual. Please remember that past performance of investments may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this post serves as the receipt of, or as a substitute for, personalized investment advice from Vermillion Financial Advisors, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed within this newsletter to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.