How much money does a typical worker need to save every month in order to have a reasonable chance of financing a secure retirement? New analysis from the Center for Retirement Research at Boston College (CRR) came up with a broad overview of the rates needed by different age groups and income levels.

To estimate necessary savings rates, the researchers first sought to determine what level of retirement income would provide an equivalent standard of living to a retiree’s final year of pre-retirement income. After they took account of changes in various tax burdens, commuting expenses, housing costs and other factors, they estimated that a single worker earning $20,000 prior to retirement (the CRR study’s “low” income) would need about 88% or $17,600 during retirement, including Social Security benefits calculated according to the current formula. Someone earning $50,000 (“medium” income) would need about 90% or $40,000 after retirement, and someone earning $90,000 (“high” income) would need about 81% or $73,000. Both of those estimates also assume the current levels of Social Security benefits.

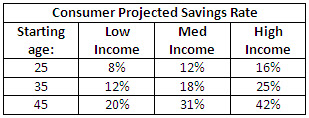

Here’s how the projected savings rates work out for a consumer at each level, assuming a normal retirement age (67) and an average annual investment return of 4% after inflation is taken into account:

A low income retirement saver would need to set aside 8% of income each years starting at age 25. If the same person were to wait until age 35 to start, the rate would go up to 12% of their income per year. If the same person were to wait until age 45, the necessary savings rate would rise to 20% per year.

A medium income retirement saver starting at age 25 would need to set aside 12% per year. Waiting to start until age 35 to start the savings boosts the rate to 18%. Waiting until 45 pushes it to 31%.

A high earnings saver would have to set aside 16% per year starting at age 25. If he or she waited to start until age 35, the rate would increase to 25%. Waiting until 45 causes the required savings rate to rise to 42%.

Keep in mind that if Social Security were to be cut back, savings rates would have to be increased proportionately to cover any reductions in anticipated benefits. Also keep in mind that if real investment returns average higher than 4% in the future, the amount of savings can be reduced somewhat. But the researchers noted that “…the effect of rate of return on required saving rates, for workers at all earning levels, is smaller than the effect of the age at which saving starts and, especially, the age of retirement.” In other words, start your savings program earlier and then working longer could have the greatest impacts on your financial readiness for retirement.

how much you need to save for retirement

Note: The opinions voiced in this material are for general information only and not intended to provide specific advice or recommendation for any individual. Please remember that past performance of investments may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this post serves as the receipt of, or as a substitute for, personalized investment advice from Vermillion Financial Advisors, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed within this newsletter to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.

Continue reading and jump to the next post,

Bad choices get rewarded