The indomitable American shopper used to power the world economy, and it was nice while it lasted

One of the most telling signs of the new normal in the U.S. economy is Americans’ attitudes toward saving money. Ten years ago, saving was like making your bed or changing the oil in your car on schedule: Nice to do but hardly essential.

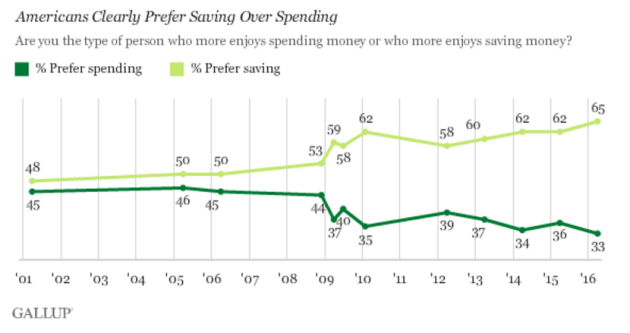

In April 2006, 51% of Americans thought their financial situation was good or excellent, but by April 2010, the percentage had dropped to 41%. During roughly the same period, with unemployment reaching as high as 10% and wages stagnant, the appeal of saving over spending grew from 50% to 62%.

In April 2006, 51% of Americans thought their financial situation was good or excellent, but by April 2010, the percentage had dropped to 41%. During roughly the same period, with unemployment reaching as high as 10% and wages stagnant, the appeal of saving over spending grew from 50% to 62%.

During the brutal recession that began in 2007, people got more serious about saving. But as the economy recovered, Americans didn’t return to their old shopping habits, which amounted to spending almost their entire incomes, month after month. Instead, they decided to save even more.

With only 33% of Americans now saying they prefer spending, the gap between those who prefer saving and those who prefer spending is at its widest since 2001. This Gallup chart shows the startling surge in Americans’ preference for saving over spending in recent years.

That’s good news for the economy of the future but something of a problem now.

Consumer spending still accounts for two-thirds of the U.S. economy, and it has grown at a paltry 2.2% per year, after adjusting for inflation, since the end of the recession.

There are several things depressing economic growth – stagnant wages, a strong dollar, weak exports, tepid growth in other countries – but it doesn’t help that American consumers would rather save than spend. And it helps explain why many big companies are reporting flat revenue and profit numbers.

The weakest spending categories are food, clothing, footwear, recreation, and financial services. Part of the reason for the decline may be lower prices, but the glory days for many retail goods seem to be in the past.

As the percentage preferring saving increased significantly, most of the movement in this direction occurred among the younger age groups, illustrating that once-obvious differences among age groups before the crisis have now almost disappeared.

In the early 2000s, 18- to 29-year-olds were the least interested in saving of any age group, with just 43% saying they prefer saving over spending. Today, they’re the most determined to save, with 66% saying that’s their preference. Among 31- to 49-year-olds, just 61% favor saving.

The poll also shows those who are spending more tend to think this is temporary, while those who are spending less are more likely to think it will be permanent — further supporting the conclusion that Americans are settling into a mode in which they are mentally focused on being thrifty.

The poll also shows those who are spending more tend to think this is temporary, while those who are spending less are more likely to think it will be permanent — further supporting the conclusion that Americans are settling into a mode in which they are mentally focused on being thrifty.

Americans don’t always do what they say they want to do, and the saving rate hasn’t soared the way the intention to save has.

The prolonged drop in the saving rate that began in the early 1970s coincided with the soaring use of credit cards and other types of consumer debt. By 2005, when the saving rate bottomed out at 2.6%, many consumers felt that buying a home amounted to saving enough, since the value of homes always went up. The epic housing bust that followed corrected that misunderstanding, plus the homeownership rate fell as foreclosures forced many former owners to rent, and others lacked the strong credit needed to qualify for a mortgage. Old-fashioned saving became popular again.

Saving rates that had dropped from the double-digit levels of the 1960s and 1970s down to an abysmal 1.9% rate in July 2005 are now consistently close to or above 5%, which is still low by historical standards – but it’s slightly higher than the average of the last 15 years. Some economists are expressing concern that Americans aren’t spending enough to keep the U.S. economy growing at a healthy pace. The question now becomes whether the apparent changes in attitude will affect savings rates more than they have to date — and what effect this will, in turn, have on the vitally important retail sector of the U.S. economy.

The new reality, however, is that Americans are now considerably more likely than they were in the easy-credit years preceding 2008, to perceive saving money as more enjoyable than spending it.

VFA has seen through the years that these shifts in attitude and actions usually cease to be a trend and eventually become the norm at some point in time. Therefore, the VFA viewpoint remains the same as always with regard to savings: Everyone should save at least 10% of their earnings every year – using 10% as a starting point with the goal of eventually saving 20% of their earnings every year.

As Americans have seen their own finances improving, they have continued to value saving over spending, and Vermillion Financial Advisors heartily approve.

Source: Rick Newman for Yahoo! Finance

Note: The opinions voiced in this material are for general information only and not intended to provide specific advice or recommendation for any individual. Please remember that past performance of investments may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this post serves as the receipt of, or as a substitute for, personalized investment advice from Vermillion Financial Advisors, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed within this newsletter to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.